If you’re wondering, “Can a college student get Medicaid?” the answer is yes. Medicaid is a health insurance program that can provide coverage for eligible individuals.

When you’re navigating the various health insurance options available, keep in mind that Medicaid provides essential benefits, and some states have expanded Medicaid to cover more low-income individuals.

1. Can a College Student Get Medicaid?

Medicaid is a health insurance program that helps low-income people get essential healthcare. It’s available to specific groups like pregnant women, seniors, children, and people with disabilities.

Your Medicaid eligibility generally depends on:

- Income: Your household income must be within a certain range, usually at or below 138% of the Federal Poverty Level (FPL) in states that have expanded Medicaid under the Affordable Care Act (ACA).

- Family size

- Age and disability status

- State of residence (every state has different rules)

Can you get Medicaid as a college student?

College students can get Medicaid, but it all depends on their situation.

- Income: In expansion states like California, low-income college students who are financially independent may qualify for Medicaid.

- Dependency status: If your parents claim you on their tax return, their income may count, which could disqualify you. But if you file taxes independently and have a low income, you have a better chance.

- Your state: Every state has different rules. In states without Medicaid expansion, like Texas, it could be harder because non-disabled adults without kids generally don’t qualify for Medicaid, even if they have no income.

- Special circumstances: If you’re pregnant or have a disability, you may qualify for Medicaid under separate eligibility rules. (In fact, about 17% of adults aged 19 to 26 enrolled in Medicaid have a diagnosed physical condition, and 1 in 5 have a behavioral health condition.)

2. How to Apply for Medicaid as a College Student

College students can apply for Medicaid at any time of year. There are some main ways to get started:

Apply Through Your State’s Medicaid Agency:

Each state manages its own Medicaid program, apply in the state where you currently live. Contact your state Medicaid agency. You will get the exact eligibility rules and required documents.

Apply Through the Health Insurance Marketplace:

You can also apply through the Health Insurance Marketplace. When you fill out the general application, the system will check if you (or anyone in your household) qualify for Medicaid. If you do, your info will be forwarded to your state’s Medicaid office, and they’ll reach out to complete the process.

To avoid application delays, have these documents ready:

- Full name and date of birth

- Social Security Number

- Proof of income

- Citizenship or immigration status

- Current health insurance details (if you have coverage)

- Housing expenses (rent, mortgage, or utility bills)

- Information on other benefits, like SNAP and SSI

3. What Coverage Does Medicaid Offer for College Students?

Medicaid offers a wide range of health coverage for eligible college students, often at little to no cost. Federal guidelines require all Medicaid programs to provide certain mandatory services, and many states offer additional optional Medicaid benefits.

Here’s what college students can expect Medicaid to cover:

Mandatory Medicaid benefits, such as:

- Doctor visits

- Hospital services (inpatient and outpatient)

- Laboratory and X-ray services

- Family planning services

- Transportation to medical care

Optional Medicaid benefits:

- Prescription drugs

- Clinic services

- Physical therapy

- Dental services

- And more

>>> Also read: Free Laptop With Medicaid: Here’s Everything You Need To Know

4. Expand Medicaid Benefits for College Students

College students on Medicaid might not know that if they enrolled in Medicaid, they can qualify for other government assistance programs, and one of the most valuable for students is Lifeline.

The Lifeline program helps reduce your monthly phone or internet bill. In most cases, you can get up to $9.25 off per month, or $34.25 if you live on Tribal lands. But that’s not all. In many states, like California, Kentucky, Oklahoma, and more, certain Lifeline providers, such as AirTalk Wireless, offer plans with highly discounted or free smartphones, tablets, and even smartwatches.

Since Medicaid is one of the approved government programs for Lifeline, college students who already receive Medicaid benefits are eligible. That means if you’re on Medicaid, you can get free or discounted phone service, too.

Step 1: Visit the AirTalk Wireless Website

Go to the official AirTalk Wireless website and enter your ZIP code to check availability in your area.

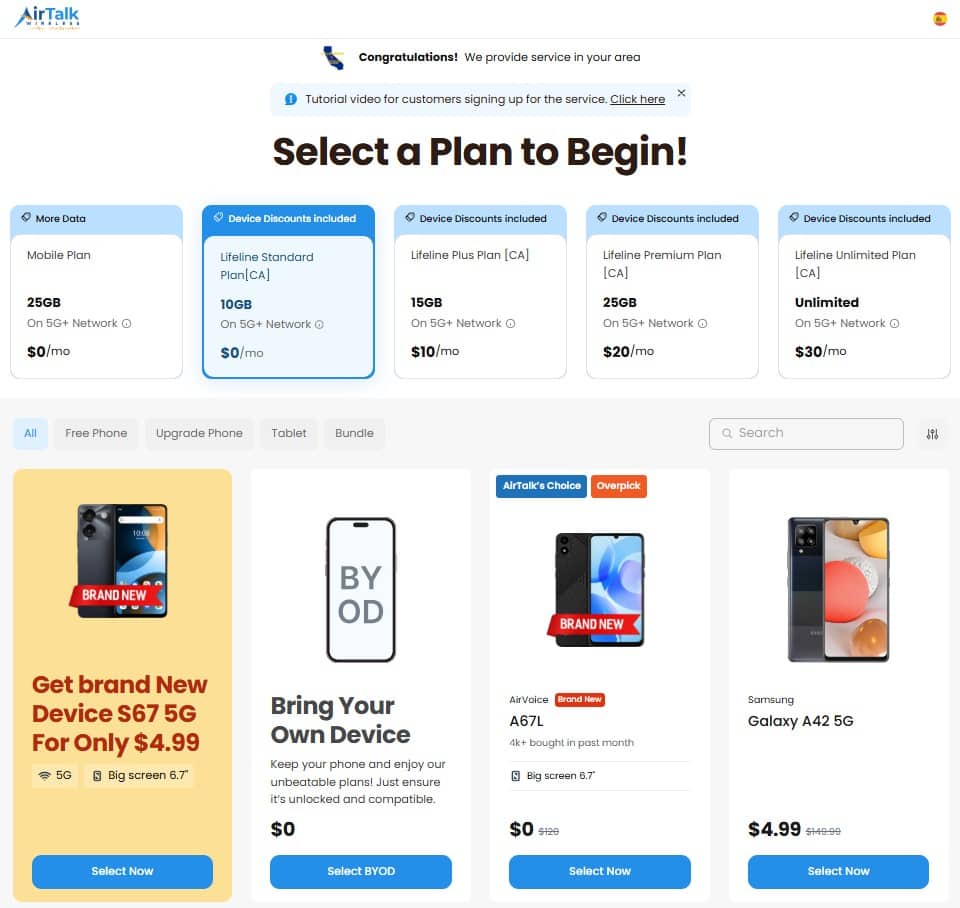

Step 2: Choose a Plan

You’ll be presented with two options:

- Free Phone + Plan: Get a free device along with your service.

- Bring Your Own Device (BYOD): Choose this option to keep your current device while still enjoying Lifeline benefits.

Step 3: Pick a Device

If you selected the Free Phone + Plan option, you can choose from a range of free devices, from smartphones to tablets.

Step 4: Provide Documentation

Upload valid documents. Since you qualify through Medicaid, you may need to submit an official benefits letter or enrollment confirmation.

Step 5: Submit Your Application

Submit your application online. AirTalk Wireless will review your information and verify eligibility. If approved, you’ll receive a confirmation email.

5. What If You Don’t Qualify for Medicaid? Other Health Insurance Options for College Students

Medicaid is just an option. If you’re not eligible for Medicaid, there are still other options for health insurance for college students.

Student Health Insurance Plans (Offered by Colleges):

Around 3 million students are covered by student health plans, which are offered by colleges, universities, or other higher education institutions.

Student health insurance plans meet the needs of students and often include coverage for doctor visits, emergency care, and mental health services.

Stay on a Parent’s Insurance Plan Until Age 26:

Under the Affordable Care Act (ACA), you can remain on your parent’s health insurance plan until you turn 26. This coverage is available even if you’re married, having a child, or living on your own.

After you turn 26, you need to seek alternative coverage through your employer, the Health Insurance Marketplace, or another source of health insurance for young adults.

ACA Marketplace Plans:

You can explore options on the Health Insurance Marketplace. Depending on your income, you can qualify for subsidies that make coverage more affordable.

Medicare:

Medicare is generally for people over 65, but some younger individuals with disabilities or certain medical conditions may qualify. If you’re a college student who meets these specific criteria, Medicare could be an option.

Also read: Medicare Free Cell Phone: How You Can Get Free Service & Phones

Conclusion

Be prepared to offer any necessary information, as this will ensure that you receive the full benefits you’re eligible for. Remember, Medicaid makes healthcare more accessible, and take advantage of the coverage and extended perks available to college students.